Big news today! Semrush has announced in a press release that they are going public. In an initial public offering, they are embarking on a journey few in the SEO space have undertaken, so it will be interesting to see how they do. The number of shares of the company or the price being offered for them have not yet been disclosed.

The stock ticker that Semrush will be under is the symbol “SEMR”.

Semrush IPO Press Release

From the press release:

“Semrush Holdings, Inc. (“Semrush”), a leading online visibility management SaaS platform, today announced that it has publicly filed a registration statement on Form S-1 with the U.S. Securities and Exchange Commission (the “SEC”) relating to a proposed initial public offering of its Class A common stock. The number of shares to be offered and the price range for the proposed offering have not yet been determined. Semrush intends to list its Class A common stock on the New York Stock Exchange under the ticker symbol “SEMR”.

Goldman Sachs & Co. LLC, J.P. Morgan Securities LLC and Jefferies LLC will act as joint lead bookrunning managers. KeyBanc Capital Markets Inc. will also act as a joint bookrunning manager for the proposed offering. Piper Sandler & Co. and Stifel, Nicolaus & Company, Incorporated will act as co-managers.”

Twitter has been blowing up with news about the IPO, with many in the industry commenting on the potential ramifications.

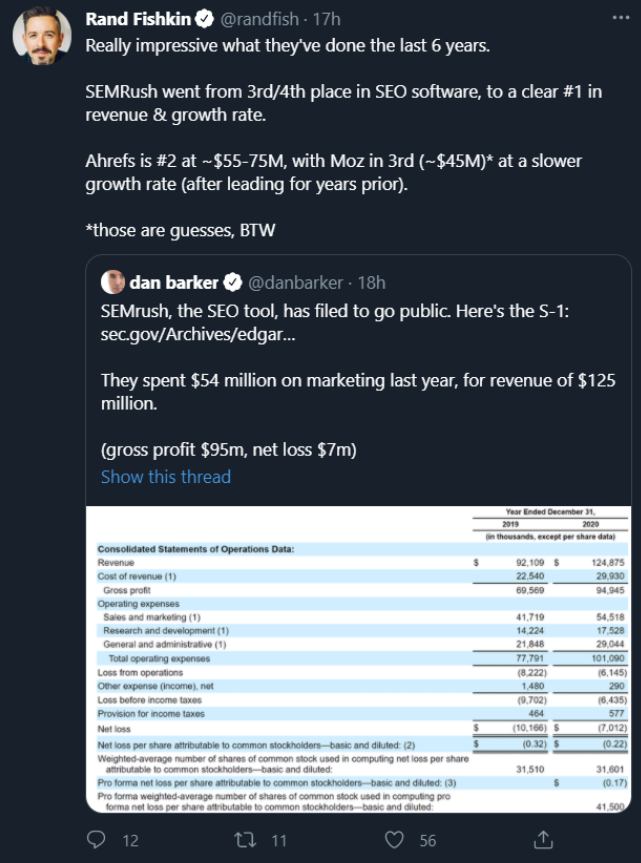

Barry Schwartz over at Seroundtable reported that they “spent $54 million in advertising to gain customers as quickly as possible after getting an influx of cash with a funding round of $40 million in 2018.”

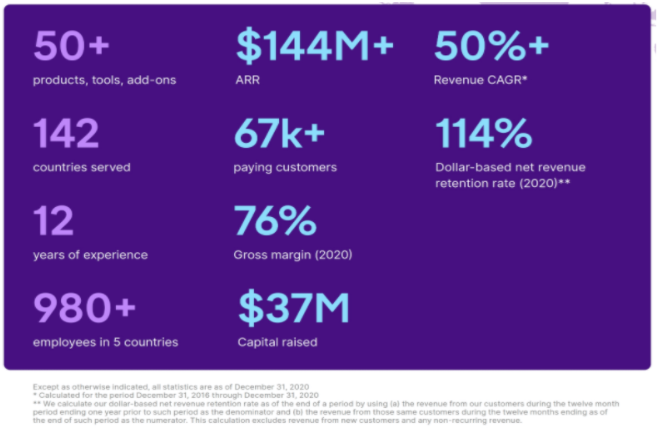

Semrush also provided the following numbers in their initial SEC filing documents:

Dan Barker had a great initial analysis on the move:

Rand Fishkin also had more insight into the IPO, retweeting Dan’s tweet:

This is a significant move for Semrush and it will be interesting to see how this impacts operations and the software company as a whole.

As a company, I think they are a solid performer and something that should be a part of any serious SEO’s toolset.

Why Is the Semrush IPO Important?

Semrush is one of the first SEO tool companies to go public on the New York Stock Exchange. Looking at them from the outside in, this is probably why they standardized their name a couple of months back to Semrush as an overall company trajectory strategy.

As one of the first companies to do this, watching what happens to them will be an exercise in observing what the typical SEO company could look like as they embark on the IPO.

This also holds significant insight for those of us in the industry who use Semrush and others who may want to try and emulate their success. It could help answer questions like: what does an SEO tool company that goes public look like?

For those who don’t know, Semrush is an SEO platform that allows digital marketers to compile data about many different aspects of their SEO campaigns. From links, to traffic, content, and social media, Semrush offers many data points for competitor analysis, managing your SEO campaign, ongoing client reporting, and much much more.

Congratulations to all at Semrush on the change!! Keep up the great work, everyone.

Find Our More About Semrush Through Our Comprehensive Guides

We have a number of comprehensive guides to using Semrush that could help you solve your SEO issues. They include the following:

- 33 Ways to Use Semrush’s Site Audit Tool to Solve Site Errors

- Semrush Guide: Monitor Your Rankings and Online Visibility

- 31 Things You Can Do With Semrush’s Site Audit Warnings Tool

- Achieve Next-Level Technical SEO with Semrush’s Site Audit Tool

And many others. Be sure to visit our Semrush Tool Section to browse all of our guides today.